Have you ever wanted to purchase silver without breaking the bank?

You are not alone! If you are wondering how to buy silver at a spot price, then that is not hard science. That’s a smart silver investment.

Silver is a popular precious metal for collectors and investors due to its use in industrial applications, jewelry, and money.

The spot price of silver refers to the current market value of an ounce of pure silver, which is influenced by factors such as supply and demand, interest rates, inflation, currency exchange rates, and geopolitical developments.

Buying silver close to the spot price can save you money.

By keeping up-to-date with the current spot price and having access to a reliable source of silver, you can ensure that you're getting the best deal possible.

But how to buy silver at spot price remains a constant question.

So, in this article, we'll dive into the exciting world of silver purchasing, discussing the various ways to buy silver close to the spot, the factors that impact silver spot prices, and the premium over spot price.

Whether a seasoned silver investor or starting, prepare to learn everything you need about purchasing silver bullion like a pro!

Spot Price Basics: A Quick Overview

Have you ever wanted to purchase silver without breaking the bank?

You are not alone! If you are wondering how to buy silver at a spot price, then that is not hard science. That’s a smart silver investment.

Silver is a popular precious metal for collectors and investors due to its use in industrial applications, jewelry, and money.

The spot price of silver refers to the current market value of an ounce of pure silver, which is influenced by factors such as supply and demand, interest rates, inflation, currency exchange rates, and geopolitical developments.

Buying silver close to the spot price can save you money.

By keeping up-to-date with the current spot price and having access to a reliable source of silver, you can ensure that you're getting the best deal possible.

But how to buy silver at spot price remains a constant question.

So, in this article, we'll dive into the exciting world of silver purchasing, discussing the various ways to buy silver close to the spot, the factors that impact silver spot prices, and the premium over spot price.

Whether a seasoned silver investor or starting, prepare to learn everything you need about purchasing silver bullion like a pro!

Spot Price Basics: A Quick Overview

The current market value of an ounce of pure silver is known as the spot price of silver.

The spot price of silver is volatile, and the narrow range of factors may influence economic data releases, market sentiment, political developments, natural disasters, and decisions made by central banks may be the reason.

The price you pay when purchasing silver from a local or online dealer differs from the spot price. Without accounting for extra expenses like manufacturing, distribution, handling, shipping, or taxes, the spot price only represents the intrinsic value of silver.

What is Premium Over Spot

When you purchase silver from a dealer or online merchant, you pay more than the spot price.

The amount the seller charges to turn a profit and pay their overhead is known as the premium. It may differ based on the type, size, and quantity of silver bullion products you purchase and the seller's location and reputation.

The availability of silver products and the market condition can also affect the premium.

For instance, a high demand for silver coins or bars could result in a limited supply, raising the premium. On the other hand, if there is little demand for silver goods, there might be more inventory, which would lower the premium.

Spot Price Vs Premium

| Determination | The spot price of silver is the current market price of one ounce of pure silver. | The cost goes beyond the spot price, which comprises manufacturing, distribution, and dealer markup expenses. |

| Determination | UThe spot price of silver is the current market price of one ounce of pure silver. | Varies according to several variables, including coin type, brand, rarity, and market circumstances. |

| Stability | Fluctuations can be observed frequently during the trading day. | Usually more constant than the spot price but subject to fluctuations in the market. |

| Influence | Influenced by investor sentiment, geopolitical developments, and global economic factors. | Influenced by dealer pricing tactics, brand reputation, and the need for particular products. |

| Transparency | Transparent and readily available via internet platforms and financial news sources. | Less clear and might necessitate speaking with dealers directly or researching particular goods. |

How to Buy Silver at Spot Price

It is often asked whether it's possible to buy silver at spot price or how to buy silver at spot price.

Unfortunately, the answer to these questions is "NO".

While it is rare to find silver bullion available at the spot price, you can still acquire silver bullion products that are priced close to the spot price.

Consider the following steps before purchasing to increase your chances of obtaining silver holdings at a price that is near the spot price.

Steps to Buy Silver Near to Spot Price

1. Select Products First: Online and physical retailers sell silver through coins, bars, and rounds. Premiums on silver bars and coins vary, depending on the product. Rare coins in mint condition can be expensive.

To get close to the spot price, choose the right products and do your research. Dealer premiums on bars and rounds are typically lower than on other products.

2. Examine Current Spot Price: Before making any purchases, research the current spot price for your bullion products.

BOLD Precious Metals provides real-time silver spot price charts. Be informed about the current prices of gold and silver before attempting to buy.

3. Locate Reputable Dealers: To get the best deals on premium bullion products, you must locate a reliable and trustworthy online dealer.

BOLD Precious Metals is a trustworthy and reputable dealer that offers a vast selection of premium gold and silver bullion products at the lowest prices.

4. Compare Prices: To find the best offers, compare the product prices at the websites of several dealers while selecting a trustworthy dealer.

5. Think About Purchasing in Bulk: Many bullion dealers offer substantial per-ounce discounts to buyers purchasing large quantities. Dealers frequently list these bulk discounts on their websites. The higher the amount you buy, the lower the premium you pay.

6. Look for Sales or Offers: Dealers frequently try to sell extra stock by offering the products at a steep discount. These "sales" can provide a fantastic chance to purchase coins or bullion at extremely low premiums over the spot.

Tobuy silver bullion at the spot price or very close to the spot price,visit BOLD’s deals page or select “View All Sale Items”.

7. Consider Storage: Before making any purchases, it's also crucial to consider storage options, especially for silver bars. Several storage options include vaults, bank storage, and depositories.

At BOLD, we recommend 7 different depositories for secure storage.

8. Complete the Purchase: Following the above steps, you can purchase silver bullion with a secure storage option close to the spot price.

Factors Affecting Silver Spot Prices

If you’re thinking about how to buy silver at spot price you need to consider the several factors affecting the silver spot price.

1. Demand and Supply

This is the basic idea behind the price of any commodity. While increased mine production or higher recycling rates can put downward pressure on prices, rising global demand for silver from industries like electronics and solar panels can drive up prices.

- Industrial Demand: Silver has unique qualities, including high thermal and electrical conductivity. Therefore, it is used in various industrial applications, including electronics, solar panels, and medical equipment. An increase in industrial demand may raise the spot price of silver.

- Investment Demand: Investors purchase silver to diversify their portfolios or hedge against inflation and currency devaluation. As a result, the spot price of silver may rise in response to increased demand.

- Jewelry Demand: Silver is widely used in producing jewelry and silverware. The demand for these items can increase the value of silver in the market.

On the other hand, the production of silver can be affected by various factors such as mining output, recycling, and government sales. A decrease in the supply of silver can cause a corresponding increase in spot prices.

2. Macroeconomic Factors

Macroeconomic variables can also impact the spot price of silver. Among the crucial elements are:

- Inflation: Silver is frequently viewed as a hedge against inflation since it is an asset with intrinsic value. As inflation expectations rise, the spot price of silver may increase as investors seek to protect their wealth from inflation.

- Changes in Currency: US dollars are usually used to quote the spot price of silver. Silver is relatively less expensive in other currencies when the US dollar declines, which may spur demand for the metal and raise its spot price. On the other hand, a stronger US dollar may cause the price of silver to decline.

- Economic Growth: A strong world economy may boost the need for silver in industry, raising the metal's spot price. Economic downturns, on the other hand, may decrease industrial demand and drive down prices.

3. Market Condition

Silver spot price, in the market, experiences major effects due to market conditions. Among the variables influencing market sentiment are:

- Geopolitical Tensions: Political unrest, terrorist acts, wars and conflicts around the world are, hence, the main factors that bring the investors unforeseen problems. Investors might prefer to protect their portfolios from political and economic risks by purchasing safer metals, like silver.

- Market Speculation: With technical analysis, market trends, and other elements that may affect the gold prices, many traders and investors are constantly used to anticipate where the silver prices would be heading. Though the speculation will result in short-term price movement, mostly, the silver market will go unharmed.

- Market Manipulation: Occasionally, cases of market manipulation can affect the cost structure of silver in spot market. By way of such an example, if a prominent company managing supply and demand tries to intervene by offering huge orders to either buy or sell silver, this can bring temporary instability to its price.

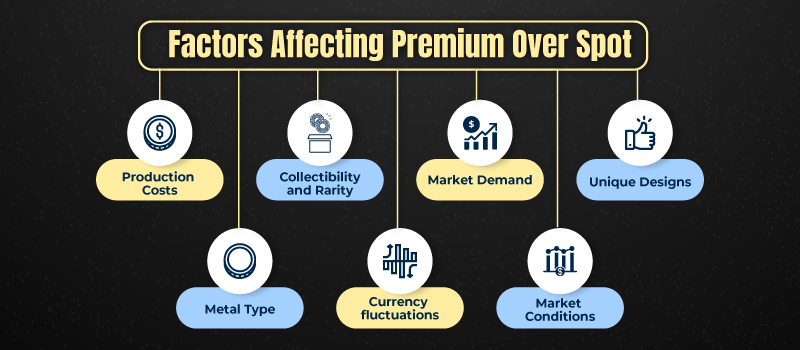

Factors Affecting Premium Over Spot

- Production Costs: The intricacies of fabricating silver coins, rounds, and bars can impact their premiums. Often more detailed, coins may incur higher production costs, influencing their premiums.

- Collectibility and Rarity: Collectibility and rarity play a significant role in premiums, particularly regarding limited mintage or collectible designs. Items with historical significance or unique qualities can fetch higher prices from collectors.

- Market Demand: An essential component is the law of supply and demand. Items in great demand could have higher premiums, especially when interest in precious metals surges.

- Unique Designs: A product's distinctiveness and visual appeal can affect its price. Coins with limited editions or bars with elaborate designs might have higher premium prices.

- Metal Type: Variations in gold and silver precious metals can result in different premium dynamics. Due to its unique qualities, gold may fetch a premium over silver.

- Currency fluctuations: Since silver is priced in US dollars and the dollar's value is inversely correlated with the price of silver, fluctuations in currency values may impact the price of silver. Investors turn to more stable assets, such as silver, which tends to appreciate when the dollar declines.

- Market Conditions: If a market has lower liquidity, meaning it's less easy to buy and sell the commodity quickly, sellers might add a higher premium to compensate for the potential risk of holding onto the product.

Spot Price Deals: Dealers' Perspective

Spot price deals can be beneficial for dealers in three ways.

Firstly, they can attract a targeted audience to their website.

Secondly, buyers tend to increase their purchase quantity to get the bullion at the lowest premium or near the spot. This increase in demand also raises the dealers' selling quantity and profit margins.

Lastly, dealers can clear their old inventory with spot price deals and generate profits from their old products.

Spot Price Deals: Buyers’ Perspective

Possibility of Lower Prices:Supply and demand determine spot prices, which vary. In contrast to fixed contracts, buyers may be able to secure goods at a reduced price when there is a surplus.

Flexibility:Compared to fixed contracts, spot deals provide more flexibility. You can avoid overcommitting by only purchasing what you need at that moment.

Swift Transactions:Unlike negotiating long-term contracts, spot deals frequently conclude more quickly.

Conclusion

In conclusion, novice and experienced investors may find that purchasing silver at the spot price or near the spot price is a wise course of action.

With this article, you must have got an answer to your question of how to buy silver at spot price. Even though it's uncommon to find silver assets or bullion available at the exact spot price, you can still secure silver assets at prices close to the spot by using the procedures this article outlines.

Recall to compare prices, select reliable dealers, stay current on the spot, buy in bulk to take advantage of discounts, and keep an eye out for sales or offers.

By adhering to these steps, you can confidently navigate the silver market and make well-informed decisions to grow your investment portfolio. Cheers to your silver buying!

FAQ

1) How Much Above Spot Should I Pay for Silver?

The amount of money you should spend over the spot price when purchasing silver depends significantly on the kind of silver you are buying and the state of the market.

Bullion coins have slightly higher premiums than silver bars and rounds, which typically have lower premiums. The product's condition, rarity, and purity will all impact the premium.

It's crucial to weigh the premiums attached to each item when purchasing silver and decide if they align with your investing objectives.

2) How Often Does the Spot Price of Silver Change?

The spot price is the current market value for prompt delivery. Because of this, during active trading hours, the spot price of silver can fluctuate several times in a minute.

The dynamics of supply and demand, economic information, geopolitical events, currency exchange rates, market conditions, and the value of the US dollar all contribute to the constant fluctuations in the spot price of silver.