Ultimates Silver Investment Guide “In a world where stability is highly valued, one precious metal stands out as a symbol of optimism:Silver.”

Many experts recommend investing in precious metals, with silver being one of the promising investment options. But you may wonder- ‘why silver investment is essential’, ‘what makes it so special?’ So here we are to provide you with the ultimate reason why you should choose silver investment by exploring its historical performance throughout the years during the economic crisis. Another reason silver is a popular choice for investors due to its high industrial demand, affordability, high liquidity, and potential for growth.

Let us dive into Jeff's story here. Growing up, Jeff’s father always taught him to invest in precious metals. By then, he invested in silver for around 12 years and owned over 3000 oz of silver. And little did Jeff know, his extensive collection of silver was on the verge of opening up a realm of financial potential.

One day, he made a conscious decision to venture to the local pawn shop to sell his silver and test whether he could get better value for his investment. The pawn shop owner offered him $111,000 for his silver, which he quickly accepted because the value surpassed much more than his initial investment. By getting this high value from his investment, Jeff was thankful to his father for teaching him about silver investment.

Through Jeff's story, we glimpse the ever-growing value of silver, a testament to its timeless appeal. Are you intrigued by the possibilities? Dive straight into this ultimate silver investment guide to know is silver a good investment in 2024!

Before deciding is silver a good investment in 2024, it is crucial to examine how silver has outperformed in past economic crises. Here are some lessons from the history. Let's dig in.

Silver, a precious metal cherished for centuries, has always been a reliable store of value. Its limited supply and enduring worth have made it a go-to asset, especially during economic instability. In the mid-nineteenth century, the United States witnessed a remarkable silver rush from 1859 to 1893, igniting local economies and transforming communities. This pivotal moment marked a significant chapter in American history.

Over the years, silver has demonstrated its ability to preserve wealth during inflation. Investors often flock to silver as a safe haven asset during economic uncertainty and rising inflation.

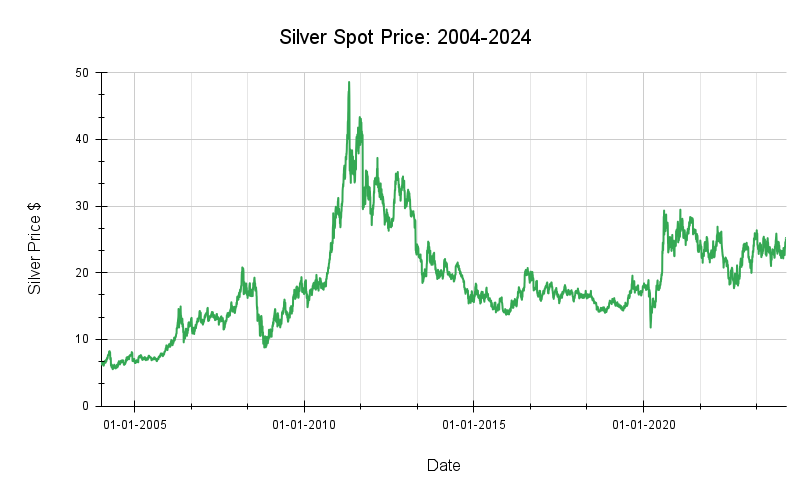

Silver has experienced a notable surge in value in the last two decades. In 2000, silver prices struggled, averaging $4.95 per troy ounce. However, by 2004, a remarkable turnaround occurred, with prices soaring by 36% to an average of $6.66 per ounce.

The 2008 global financial crisis had a major influence on the world's economy, and its consequences took hold worldwide in 2011. In 2011, silver caught a big wave, reaching a peak of $47.34, supporting traders against market turmoil.

The upward trend continued, with the spot price of silver climbing from $6.31 in 2004 to $22.96 in 2024, marking an impressive increase of approximately 263.87%. The graph below illustrates the remarkable growth in the value of silver over the years, reaffirming its status as a tangible asset for investors worldwide.

If you want to learn more about silver spot prices and stay updated on current prices, visit BOLD’s ‘ Silver Spot Price’ page before making any investment decision.

With the help of the above chart, you just learned that the price of silver has increased over the last two decades. However, you may be wondering what caused this increase. Several past events, listed below, have contributed to the rise in silver prices.

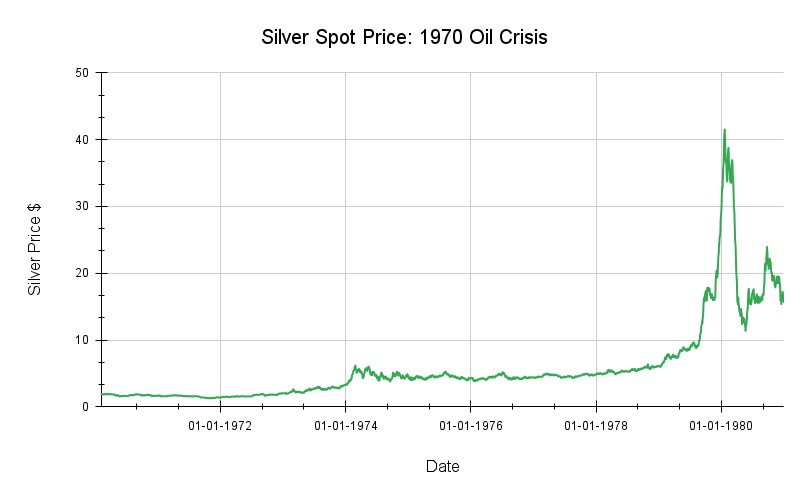

The oil crisis of the 1970s destroyed the world economy. It contributed to a stock market meltdown, skyrocketing inflation, and widespread unemployment, eventually resulting in the overthrow of the UK government. During this challenging time, people started moving toward safe-haven assets.

According to the guardian ,the crisis began in 1967 and lasted until 1979, causing a major spike in demand for the precious metal. As a result, the spot price of silver shot up by a whopping 154.25% throughout the decade.

To give you an idea of just how much the price of silver rose during this tumultuous time, consider this: Before the crisis in 1967, silver was trading at around $12 per ounce. When the crisis peaked in 1973, the price had risen to $14.82, representing a hefty 23.5% increase. And when the crisis finally ended, the price of silver skyrocketed to $30.51 in 1979.

So, what does all of this mean for investors? It suggests that purchasing silver during normal economic conditions could allow you to buy at lower prices and potentially benefit from its higher value during financial hardships. Today's lower silver price could be tomorrow's savior!

Did you know:The introduction of silver futures trading has existed for decades? However, it wasn't until the 1970s that this market experienced a significant change. With the introduction of COMEX, market participants gained a powerful tool to manage price risks and secure silver for investment or industrial use. This move added liquidity to the silver market and became a potent tool for hedging against price volatility.

In 1979, the Hunt brothers tried to corner the silver market, and they owned one-third of the world's privately held silver supply. This led to a speculative bubble and a price increase. When the Federal Reserve raised interest rates, the brothers couldn't meet their margin calls, and the price of silver collapsed. This event led to changes in regulations and higher margin requirements for trading silver futures, highlighting the importance of futures markets for risk management and price discovery. The introduction of silver futures trading has been crucial in promoting investment, controlling price risk, and providing a stable and liquid market.

Here is some advice:While investing in silver, be patient and choose steady investment growth for long-term benefits rather than falling into any speculative bubble.

A global economic recession in the early 1990s affected many people. The US was characterized by a sharp drop in GDP, high jobless rates, and severe banking and financial crises. Silver prices fell slightly during the early recession. Still, they gradually increased from an average price of $4.83 in 1990 to an average price of $5.22 in 1999 due to the high demand for silver across several industrial sectors.

This was a mild recession and did not affect the prices of silver to a large extent, as there are many other broader global factors that show a greater impact on silver prices.

The 2007–2008 Global Financial Crisis, or Global Economic Crisis (GEC), was one of the most severe worldwide economic crises. Before the start of the financial crisis, the price of silver was around $10- $15, but during the time of crisis, it increased from $20.70 per ounce in January 2007 to $28.99 per ounce at the end of February 2008. In 2011, silver prices reached an all-time high, three years after the 2007–2008 financial crisis.

In 2023, Forbes reports that silver prices have increased by around 400% in the three years after the Great Recession. This states that whenever any financial crisis occurs, people tend to move toward safe assets like physical silver bullion .

The COVID-19 pandemic not only caused a global health crisis but also had a significant impact on the economy. The uncertainty led to a surge in silver prices as investors pursued a safe haven for their money. Before the pandemic, the silver spot price was around $19. During the crisis, the silver spot price increased to $21 and peaked at $29.77 when the lockdown lifted in the USA in August 2020. According to the WHO, the COVID-19 pandemic ended on May 5th, 2023. At that time, the spot price of silver was around $24, much higher than before the crisis. It just shows how much of an impact a global crisis can have on the economy!

These are past economic crisis events during which silver has outperformed as a hedge against inflation and a safe asset. Given current circumstances, this leads us to our ultimate question: Is silver a good investment in 2024?

The ratio of gold and silver prices, known as the gold/silver ratio (GSR), is calculated simply by dividing the current price of an ounce of gold by the current price of an ounce of silver. For instance, if the price of gold is $2,000 per ounce and the price of silver is $50 per ounce, then the gold-silver ratio is 40 to 1. It is a widely used indicator among precious metals investors worldwide, showing how many multiples gold is trading relative to the price of silver.

During the 1930s Great Depression, the silver market was characterized by low demand and high inventories. The onset of World War II caused the price of gold to soar, leading to the ratio of gold and silver prices reaching nearly 100:1 at its peak.

After 1945, there was a shortage of silver due to the ensuing economic boom and rising industrial consumption, which sharply increased the price of the metal. As a result, the metric returned to normal and dropped to a low of 17:1.

Prices for silver increased in the 1970s due to a spike in demand for this precious metal. During this period, the 'Hunt speculation' also exerted a significant influence on prices. Furthermore, this indicator's value varied over the years 1900–2012, from as little as 15:1 to as much as 100:1.

Currently, in the industrial sector, silver is used in a wide range of applications, including electronics, photography, and solar cell manufacturing. The demand for silver is predicted to increase further as the world economy grows, especially in emerging markets.

But unlike gold, silver is still undervalued despite its strong demand and clear industrial significance. Many experts believe that this low rating is misplaced. They believe that due to silver's significant role in the industrial sector, its value may increase dramatically in the medium term.

One precious metal that can hold its value well in uncertain times is silver. Frequently regarded as a secure investment, it can help distribute risk and lessen the effects of market fluctuations. Generally speaking, there is little correlation between silver and other asset classes like stocks and bonds.

The historical events mentioned above should have clarified that silver is regarded as a safe haven asset, as evidenced by the fact that people turned to silver investments during the financial crisis.“Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record,” the Silver Institute said in a recent report.Electronics, solar panels, jewelry, and cars contain silver.

Liquidity is the ease and speed with which an item can be sold without significantly changing its price. It supports your ability to maintain financial stability even during a significant market decline or unplanned life disruption. Silver is considered to be an extremely liquid asset. This indicates that there are many reliable precious metal buyers and sellers, which could be advantageous, particularly in using silver to diversify an investment portfolio.

Eleven states in the United States recognize gold and silver coins as legal tender, and additional states are either in the process or have attempted to reintroduce these precious metals as money. In states where gold and silver coins as legal tender, capital gains taxes on metals sales would be removed by the state laws announcing the shift in currency from gold to silver.

The way that silver performs under various economic circumstances is fascinating and complex. Silver has proven exceptionally resilient throughout history, frequently flourishing during recessions, economic downturns, and times of high inflation.

For investors contemplating silver, knowing the various factors influencing its price fluctuations—from industrial demand and supply limits to investment trends and global economic indicators—can be informative. Silver's numerous uses and past performance trends demonstrate its potential as a flexible element of an investment portfolio, regardless of the state of the economy.

Scarcity is the primary response to the query, "Why is silver more affordable than gold?" Since gold is far rarer than silver, most of the price difference between the two metals can be attributed to this mismatch in supply and demand.

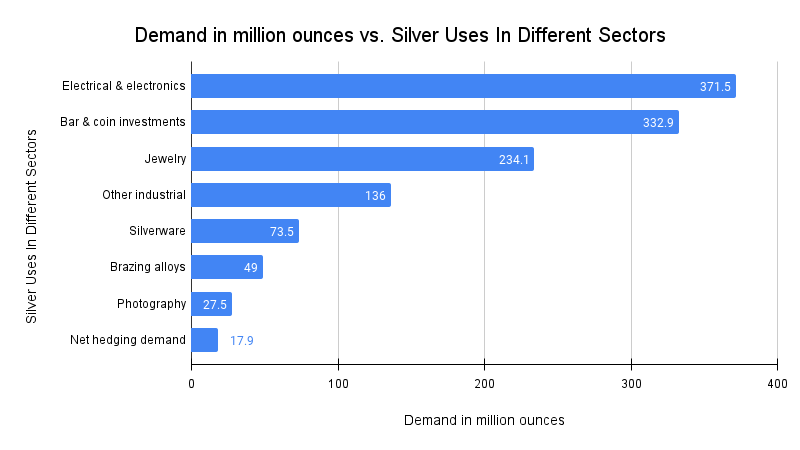

The demand for silver worldwide in 2022 was met by 234.1 million ounces thanks to the jewelry industry. That accounted for 18.8% of the world's silver demand in that particular year.

Precious metals like silver have been prized for ages. Silver has the highest reflectivity and electrical and thermal conductivity of all the metals. It is utilized in many contexts, including currency or investment in coins and bars, solar panels, water filtration systems, medical equipment, photographic and X-ray film, and jewelry.

This chart shows the demand for silver in different sectors, measured in million ounces. The major sectors driving the demand for silver include electrical and electronics, investment in bars and coins, and the jewelry industry.

Supply for silver is influenced by the fact that it is both a precious metal and used in industrial and consumer applications. Demand for silver is driven by mine supply, industrial demand, green technology demand, and investment applications.

The Silver Institute's report predicts that the global demand for silver will reach 1.2 billion ounces in 2024, making it the second-highest level ever recorded.

This growth is driven by the continued strength of industrial end-users and a recovery in the demand for jewelry and silverware.

The report forecasts a 4 percent increase in silver industrial fabrication in 2024, reaching a record of 690 million ounces. This builds on the all-time highs achieved last year. The photovoltaics (P.V.) and automotive industries are expected to continue being key growth drivers this year. Furthermore, the report predicts a 6 percent rise in jewelry demand.

Supply, industrial demand, green technology demand, and investment applications that determine the demand for silver.

The supply of raw silver in 2024 will either remain low or average, while the industrial demand for silver will increase. The two main factors impacting the industrial demand for silver in 2024 are the growth of solar and battery-electric vehicles.

According to CarGurus, electric vehicles are projected to account for up to 50% of new vehicle sales by 2030, a significant increase from 8% in 2023. The lowest estimate for electric vehicle sales by 2030 is 23%.

In 2024, silver is expected to remain a popular investment choice through physical bullion, such as silver coins and bars, silver ETFs, and stocks.

According to reports and predictions, silver demand and prices will increase. Therefore, now is a good time to diversify your investment portfolio with silver for long-term investment safety and better value in the future.

The demand for silver in various sectors is increasing globally. Here are some projections and expert reports on future silver demand.

| Institute/Experts Report | Industry | Projection and Key Point |

|---|---|---|

| 1. CarGurus | Use of silver in Electric vehicles | Electric vehicles are projected to account for up to 50% of new vehicle sales by 2030 |

| 2. The Silver Institute | 2.1) Global silver demand | 1.2 billion ounces in 2024 |

| 2.2) Use of silver industrial fabrication | 4 percent increase in silver in 2024, reaching a record of 690 million ounces | |

| 2.3) Industrial applications, jewelry production, and silverware fabrication | Demand in these three sectors is forecast to increase by 42% between 2023 and 2033 (Source Link) | |

| 3. FxEmpire | Effect of global industrial demand on silver prices in 2024 | Economic Environment Supports Price Rise to $34.43 |

| 4. University of New South Wales | Use of silver in Solar panel production by 2050 | Solar panel production will use approximately 85–98% of the current global silver reserves |

Silver is not just a pretty metal but also a reliable investment option, and it is never out of style. Silver has proved to be a reliable investment option from its historical outperformance to its future demand. as evidenced by Jeff's journey and the historical performance of this precious metal during economic crises. From its humble beginnings to its current status as a sought-after asset, silver has proven its worth as a safe haven, offering liquidity, legal tender status, resilience across various economic conditions, and affordability compared to gold.

As we navigate through history's lessons, we understand that silver's value is not just a matter of chance but a reflection of its intrinsic qualities and the evolving demands of modern industries.

From its role in jewelry to its indispensable use in electronics and green technologies, silver continues to shine bright.

Your question, ‘Is silver a good investment in 2024?’ is answered by optimistic forecasts and predictions, with increased industrial demand and ongoing market trends pointing towards a rise in silver prices. The time has come to diversify investment portfolios with silver, ensuring long-term financial stability and releasing its growth potential via physical bullion.

Expand your investment portfolio today with BOLD Precious Metals. We offer a wide range of silver coins and bars at the lowest prices, with multiple payment options for your convenience. Enjoy purchasing high-quality silver bullion products at BOLD. BOLD offers a reliable platform for beginners to invest in silver with its reliable customer services.

Having 8-plus years of experience in the precious metals market, we are dedicated to providing market expertise and support to our valued customers as they explore the world of silver investment. Investors can take advantage of the potential growth in silver investment!

Remember, silver is a new gold with promising avenues and security.